David Mercier

Earnest Money: How It Works and Why It Matters in Your Home Purchase

What is Earnest Money?

When you’re ready to buy a home and your offer is accepted, one of the first things you’ll need to do is send over something called earnest money. It’s a deposit—usually 1% to 3% of the purchase price—that shows the seller you’re serious about buying.

But why is it necessary? What does it go toward? And what happens to that money if the deal falls through? Let’s break it down.

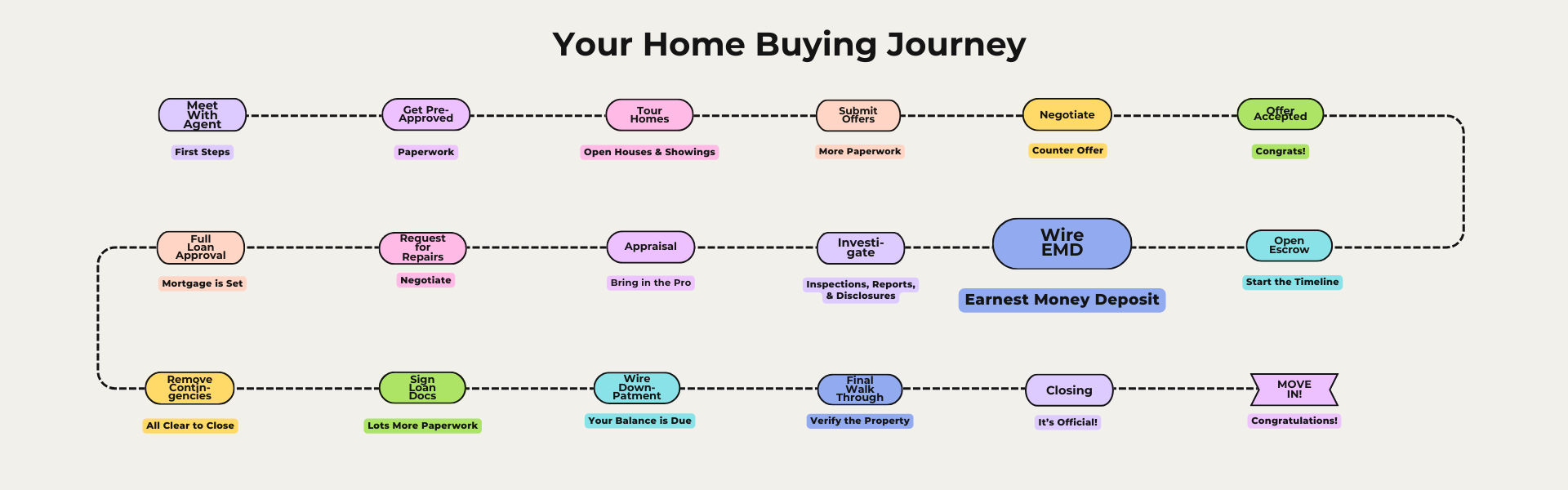

🏡This post is part of my Home Buying 101 series!

Whether you’re just getting started or deep into the search, this step-by-step guide is here to help you feel confident every step of the way.

From getting pre-approved to moving day, I’ve broken down the entire home-buying journey.

Make sure you add your questions in a comment or find me on Instagram and send me a DM: @davidkmercier

Who is this series for?

🔹 First-time buyers who want a clear roadmap.

🔹Move-up buyers ready for or on the path to their dream home.

🔹Investors looking to get started with a smart strategy and are considering options.

🔹 Anyone who hates surprises and wants to be fully prepared for their Home Buying journey!

David Mercier introduces the ultimate home-buying guide, walking you through every step of the process, from pre-approval to move-in day!

Prefer to watch instead of read? 🎥 Check out the the Home Buying Journey video series!

1️⃣ Earnest Money vs. Down Payment: What’s the Difference?

Earnest money is often confused with the down payment, but they’re not the same thing.

🏦 Earnest Money Deposit (EMD) is a small portion (typically 1–3%) of the total purchase price.

🏡 Your down payment is the larger amount you pay at closing—often 3–20% or more, depending on your loan.

📌 Think of EMD as your reservation fee. It shows the seller you’re serious and willing to put money on the line to secure the home.

⭐ Dream Homes Can Come True Club Members – We’ll chat EMD as part of our offer strategy conversation to keep your offer competitive!

2️⃣ EMD Is Agreed to in the Offer

When writing your offer, the earnest money amount is included in the purchase contract (California’s Residential Purchase Agreement). It’s one of the first financial commitments you make in the homebuying process.

💡 Pro Tip: In a competitive market, offering a higher EMD can help make your offer stand out.

3️⃣ Why Earnest Money Matters

EMD is important for both parties:

- For the seller: It shows the buyer isn’t going to walk away lightly.

- For you: It starts the escrow process and shows you’re taking action on your end of the agreement.

If you decide to back out of the deal without a valid reason covered by your contingencies, the seller may be entitled to keep your earnest money. BUT, Don’t worry, there are actually lots of protections built into the contract to protect the buyer and most of the time you’ll get your money back unless there have been damages.

4️⃣ You Can’t Start Investigations Until Escrow Receives the EMD

This is a key point most first-time buyers don’t realize:

📌 Escrow won’t release disclosures or allow inspections to begin until they receive your earnest money deposit.

So if you’re hoping to move quickly on your due diligence—like scheduling inspections, reviewing title, or requesting repairs—you need to get your EMD wired right away.

⭐ Dream Homes Can Come True Club Members – We’ll have talked about your timeline before making an offer and you’ll be prepared!

5️⃣ How to Wire Your EMD Safely

Once your offer is accepted, you’ll receive wiring instructions from the escrow company. Always verify these instructions with your agent or escrow officer by phone before sending funds.

🚨 Wire fraud is real. Never send money without confirming the details with a trusted source.

⭐ Dream Homes Can Come True Club Members – You’ll always get the go ahead from me and the escrow before wiring any funds.

6️⃣ What Happens to Your EMD After Closing?

The earnest money you send is not extra—it gets credited toward your total down payment at closing. So if you’re putting down $50,000 and already wired $10,000 as your EMD, you’ll only need to wire the remaining $40,000 later (plus your closing costs).

7️⃣ What If the Deal Falls Through?

If you cancel the contract for a reason covered under your contingencies—like inspection, loan, or appraisal—the EMD is usually returned to you.

If you back out for a reason not covered (like cold feet after contingencies are removed), the seller may be able to keep your deposit. Your agent will help you understand where your risks are and how to protect your money.

You’re Take Away

Earnest money is one of those behind-the-scenes steps that first-time buyers often overlook—but it plays a big role in how smoothly your purchase unfolds. The key is acting quickly, wiring funds safely, and understanding how it fits into your bigger financial picture.

Need help navigating your first escrow? I’d love to walk you through it. Let’s make buying your home clear, confident, and stress-free—from deposit to closing day.

Resources in your Inbox

Sign up to get new posts emailed to you