David Mercier

Title 101: Understanding Property Titles and Title Insurance

Title 101: understanding property titles and title insurance before you get too far into Escrow will make the process so much smoother.

Navigating the real estate landscape requires a solid understanding of property titles and the protections available to homeowners. This guide delves into the importance of title insurance, the process involved in issuing a title policy, how to interpret a preliminary title report, the 29 covered risks for homeowners, and the common ways of holding title to real property.

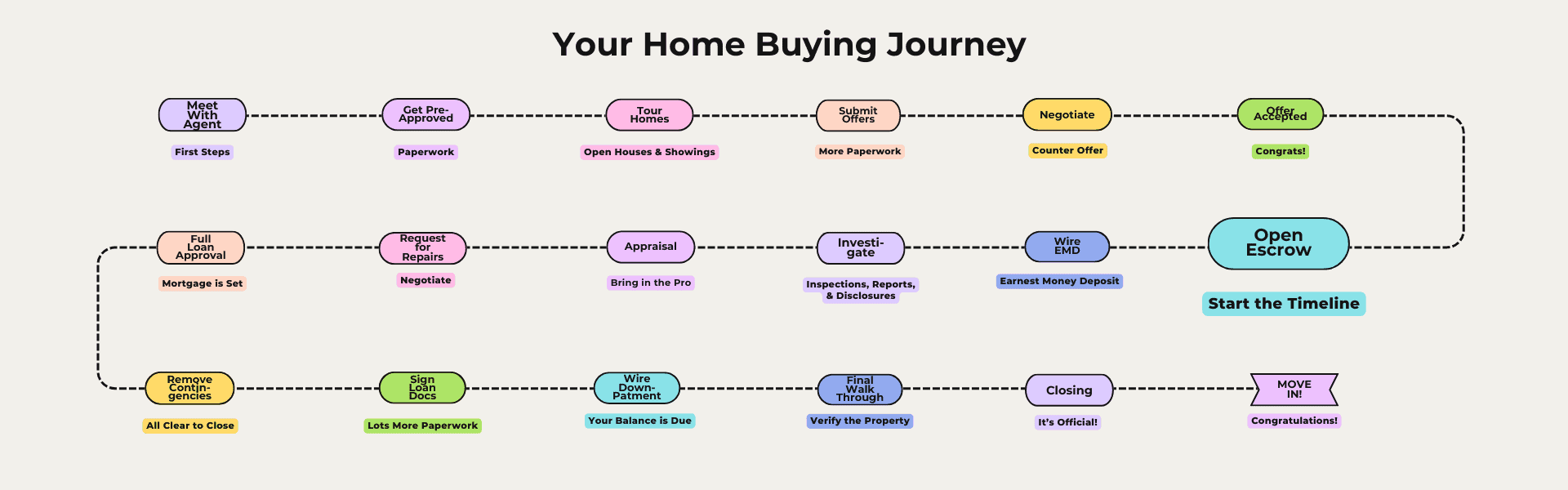

🏡This post is part of my Home Buying 101 series!

Whether you’re just getting started or deep into the search, this step-by-step guide is here to help you feel confident every step of the way.

From getting pre-approved to moving day, I’ve broken down the entire home-buying journey.

Make sure you add your questions in a comment or find me on Instagram and send me a DM: @davidkmercier

Who is this series for?

🔹 First-time buyers who want a clear roadmap.

🔹Move-up buyers ready for or on the path to their dream home.

🔹Investors looking to get started with a smart strategy and are considering options.

🔹 Anyone who hates surprises and wants to be fully prepared for their Home Buying journey!

David Mercier introduces the ultimate home-buying guide, walking you through every step of the process, from pre-approval to move-in day!

Prefer to watch instead of read? 🎥 Check out the the Home Buying Journey video series!

1️⃣ Title 101: Why Do I Need Title Insurance?

Definition:

Title insurance safeguards homeowners and lenders against financial loss from defects in the title, such as liens, encumbrances, or errors in public records.

Reasons for Necessity:

👉 Protection Against Hidden Risks: Issues like undisclosed heirs, forged documents, or clerical errors can surface after purchase, jeopardizing ownership.

👉 Legal Defense: Title insurance covers legal fees and associated costs if disputes arise over property ownership.

⭐ Dream Homes Can Come True Club Members – Usually we’ll have gone over this info. before you’ve even put an offer on a house so you’ll already have a plan!

2️⃣ Title 101: What is Involved in Issuing a Title Policy?

Process Overview:

- Title Search: A thorough examination of public records to identify any defects or encumbrances on the property.

- Title Examination: Analysis of the title search to determine the insurability of the property.

- Clearing Title Issues: Addressing any identified issues, such as liens or judgments, to ensure a clear title.

- Issuance of Title Commitment: A formal offer to insure the property, outlining any exceptions or requirements.

- Policy Issuance: After closing, the final title insurance policy is issued to the homeowner and lender (if applicable).

3️⃣ Title 101: How to Read a Preliminary Title Report

Once you’ve seen a few homes, it’s time to step back and compare.

Key Sections to Review:

👉 Legal Description: Detailed description of the property’s boundaries and location.

👉 Recorded Owner: Name of the current owner as per public records.

👉 Encumbrances: List of liens, easements, or other encumbrances affecting the property.👉 Exceptions: Specific items not covered by the title insurance policy.

Tips for Interpretation:

👉 Verify Property Details: Ensure the legal description matches the property you intend to purchase.

👉 Identify Liens or Judgments: Look for any financial claims against the property that need resolution.

👉 Understand Easements: Be aware of any rights others may have to use portions of the property.

4️⃣ Title 101: 29 Covered Risks for Homeowners

HANG IN THERE – This is quite a list. Some people want to know all the details…others skip down to #5. (No Judgement here)

- Someone else owns an interest in your title.

- Someone else has rights affecting your title arising from leases, contracts, or options.

- Someone else claims to have rights affecting your title arising out of forgery or impersonation.

- Someone else has an easement on the land.

- Someone else has a right to limit your use of the land.

- Your title is defective.

- Any of the covered risks 1 through 6 occur after the Policy date.

- Someone else has a lien on your title, including a:

- Mortgage;

- Judgment, state or federal tax lien, or special assessment;

- Charge by a homeowner’s or condominium association; or

- Lien attached before or after the Policy Date for labor and material furnished before the Policy Date.

- Someone else has an encumbrance on your title.

- Someone else claims to have rights affecting your title arising from fraud, duress, incompetence, or incapacity.

- You have neither actual vehicular nor pedestrian access to and from the land, based upon a legal right.

- You are forced to correct or remove an existing violation of any covenant, condition, or restriction affecting the land, even if the covenant, condition, or restriction is an exception in Schedule B.

- Your title is lost or taken due to a violation of any covenant, condition, or restriction occurring before you acquired your title, even if the covenant, condition, or restriction is an exception in Schedule B.

- Because of an existing violation of a subdivision law or regulation affecting the land:

- You are unable to obtain a building permit;

- You are forced to correct or remove the violation; or

- Someone else has a legal right to and does refuse to perform a contract to purchase the land, lease it, or secure a mortgage loan to it. The amount of your insurance for this covered risk is subject to your deductible amount and our maximum dollar limit of liability shown in Schedule A.

- You are forced to remove or remedy your existing structures or any part of them – other than boundary walls or fences – because a portion was built without obtaining a build- ing permit from the appropriate government office. The amount of your insurance for the covered risk is subject to your deductible amount and our maximum dollar limit of liability shown in Schedule A.

- You are forced to remove or remedy your existing structures, or any part of them, because they violate an existing zoning law or regulation. If you are required to remedy any portion of your existing structures, the amount of your insurance for the covered risk is subject to your deductible amount and our maximum dollar limit of liability shown in Schedule A.

- You cannot use the land because use as a single-family residence violates existing zoning law or regulation.

- You are forced to remove your existing structures because they encroach onto your neighbor’s land. If the encroaching structures are boundary walls or fences, the amount of your insurance for this covered risk is subject to your deductible amount and our maximum dollar limit of liability shown in Schedule A.

- Someone else has a legal right to and does refuse to perform a contract to purchase the land, lease it or make a mortgage loan on it because your neighbor’s existing structures encroach on the land.

- You are forced to remove your existing structures because they encroach onto an easement or over a building set-back line, even if the easement or building set-back line is an exception in Schedule B.

- Your existing structures are damaged because of the exercise of a right to maintain or use an easement affecting the land, even if the easement is an exception in Schedule B.

- Your existing improvements (or a replacement or modification made to them after the policy date), including lawns, shrubbery, or trees are damaged because of the future exercise of a right to use the surface of the land for the extraction or development of minerals, water or any other substance, even if those rights are excepted or reserved from the descriptions of the land or an exception in Schedule B.

- Someone else tries to enforce a discriminatory covenant, condition, or restriction that they claim affects your title based on race, color, religion, sex, handicap, familial status, or national origin.

- A taxing authority assesses supplemental real estate taxes not previously assessed against the land for any period before the policy date because of construction or change of ownership or use that occurred before the policy date.

- Your neighbor builds any structure saafter the policy date – other than boundary walls or fences – which encroach onto the land.

- Your title is unmarketable, which allows someone else to refuse to perform a contract to purchase the land, lease it, or mortgage it.

- A document upon which your title is based is invalid because it was not properly signed, sealed, acknowledged, delivered, or recorded.

- The residence with the address shown in Schedule A is not located on the land at the policy date.

- The map, if any, attached to the policy does not show the correct land location according to the public records

5️⃣ Title 101: Common Ways of Holding Title to Real Property

Ownership Structures:

- Sole Ownership: Property owned entirely by one individual.

- Joint Tenancy: Two or more individuals own the property equally with rights of survivorship.

- Tenancy in Common: Multiple owners hold individual interests, which can be unequal and separately transferable.

- Community Property: Property acquired during marriage, owned equally by both spouses (applicable in certain states).

- Trust Ownership: Property held in a trust for the benefit of designated individuals or entities.

Considerations:

- Legal Implications: Each ownership type has different legal and tax consequences.

- Transferability: Understand how each structure affects your ability to transfer ownership.

- Estate Planning: Choose an ownership structure that aligns with your estate planning goals.

⭐ Dream Homes Can Come True Club Members – I’ll set up a FREE meeting with a Title Professional so you can ask questions and choose the right option for your situation!

You’re Take Away

Understanding property titles and title insurance is vital in safeguarding your real estate investment. By familiarizing yourself with the processes and protections outlined above, you can navigate the home-buying process with confidence. For personalized guidance in Orange County or Long Beach, feel free to reach out to me, David Mercier.

You have now passed Title 101: Understanding Property Titles and Title Insurance. Congratulation!

Resources in your Inbox

Sign up to get new posts emailed to you