David Mercier

Removing Contingencies: What It Means and Why It Matters

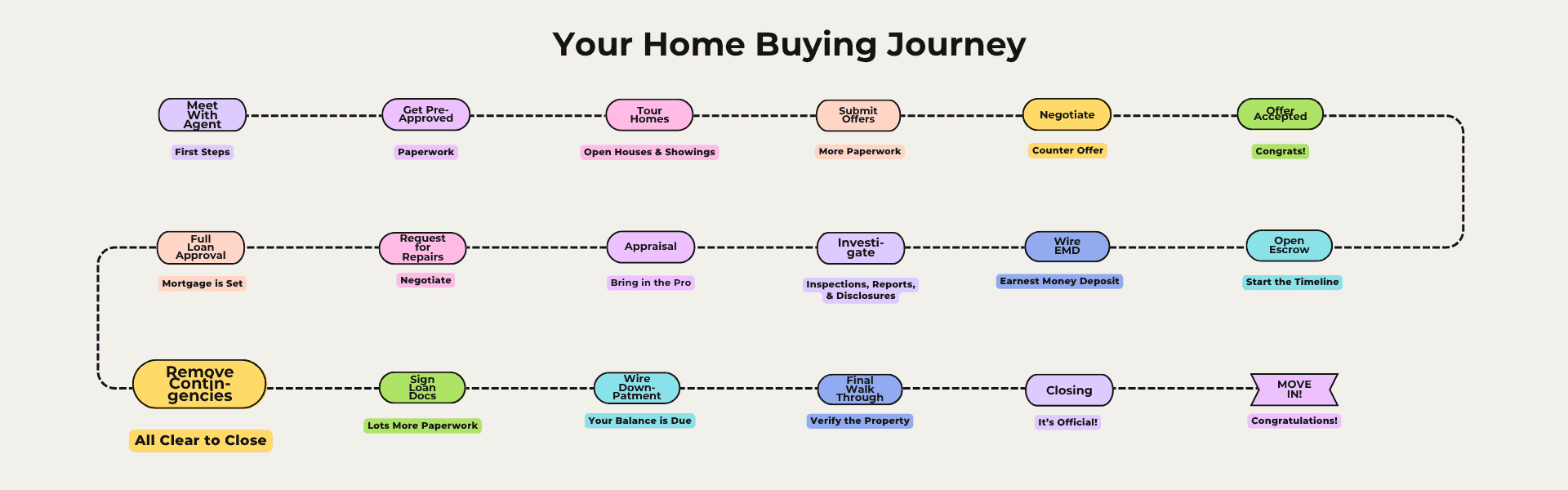

Removing contingencies is confusing for a lot of people. I’ll break it down for you to feel confident when you reach this step in your Home Buying Journey.

Once your loan is approved and inspections are done, the next major step is removing contingencies. This is the buyer’s final action before closing—and it’s a big one. Let’s talk about what it means and how to approach it with confidence.

🏡This post is part of my Home Buying 101 series!

Whether you’re just getting started or deep into the search, this step-by-step guide is here to help you feel confident every step of the way.

From getting pre-approved to moving day, I’ve broken down the entire home-buying journey.

Make sure you add your questions in a comment or find me on Instagram and send me a DM: @davidkmercier

Who is this series for?

🔹 First-time buyers who want a clear roadmap.

🔹Move-up buyers ready for or on the path to their dream home.

🔹Investors looking to get started with a smart strategy and are considering options.

🔹 Anyone who hates surprises and wants to be fully prepared for their Home Buying journey!

David Mercier introduces the ultimate home-buying guide, walking you through every step of the process, from pre-approval to move-in day!

Prefer to watch instead of read? 🎥 Check out the the Home Buying Journey video series!

▶️ What Are Contingencies in California?

Contingencies are protective clauses built into the California Residential Purchase Agreement (RPA)—also known as your offer or purchase contract. These clauses give the buyer time to investigate, evaluate, and confirm key aspects of the home and financing before fully committing to the purchase.

Each contingency serves a unique purpose, and until you remove them, you’re not legally locked into the deal. Let’s walk through the most common buyer contingencies and what you need to understand before removing them.

🏦 Loan Contingency

What it is: This protects you in case you can’t secure financing.

Why it matters: If your loan isn’t officially approved, this contingency gives you the option to walk away without losing your earnest money.

Before removing it: Make sure you’ve received full loan approval from your lender, not just pre-approval. Double-check that your interest rate, terms, and monthly payment are what you expected.

🔍 Investigation/Inspection Contingency

What it is: This allows you to inspect the property and review reports, disclosures, and other relevant details.

Why it matters: If you find major issues—like a faulty roof, foundation problems, or unsafe electrical—you can renegotiate or exit the deal.

Before removing it: You should have completed all desired inspections and feel confident in the home’s condition or have reached an agreement with the seller on repairs or credits.

🏡 Appraisal Contingency

What it is: This protects you if the home appraises for less than the purchase price.

Why it matters: If the appraisal comes in low, your lender may not fund the full loan, and you’d need to renegotiate or pay the difference out of pocket.

Before removing it: Confirm with your lender or agent that the appraisal came in at or above the contract price—or that you’re comfortable covering the shortfall if it didn’t.

📜 Disclosures Review Contingency

What it is: This gives you time to review all statutory disclosures, seller-provided documents, and government reports about the property.

Why it matters: Disclosures may reveal issues that inspections didn’t catch, such as previous insurance claims, HOA disputes, or known hazards.

Before removing it: Make sure you’ve reviewed every disclosure provided, asked any follow-up questions, and feel satisfied with the information.

🏠 Sale of Buyer’s Property Contingency (if applicable)

What it is: This applies if your ability to buy depends on selling your current home.

Why it matters: If your sale falls through, this protects you from being forced to buy a new home before you’re financially ready.

Before removing it: Your home should either be in escrow or fully closed, and your financing should no longer depend on it.

🏘 HOA/Community Disclosures (Common Interest Disclosure)

What it is: Protects you if the home is part of an HOA or other common-interest development.

Before removing: Review HOA documents, rules, CC&Rs, budgets, and meeting minutes to ensure there are no red flags.

📝 Insurance Contingency

What it is: Gives you time to confirm you can obtain adequate homeowner’s insurance.

Before removing: Get a quote from your insurer—especially if the property is in a high fire zone or has unusual risks.

🧾 Preliminary Title Report Contingency

What it is: Lets you review the property’s title to check for liens, easements, or other ownership issues.

Before removing: Review the report and confirm with your agent or title rep that the title is clear and insurable.

💼 Review of Leased or Liened Items

What it is: Covers items like leased solar panels or security systems that stay with the property.

Before removing: Ensure all contract terms have been disclosed, and you’re okay with assuming those leases or negotiating terms.

▶️ What Does “Removing Contingencies” Mean?

Removing a contingency means you’re officially satisfied with that aspect of the deal—and you’re committing to move forward without needing that safety net. At this stage, you’ve reviewed the relevant documents, completed any inspections, resolved concerns, and made peace with the property’s condition and value.

Once removed, that contingency no longer protects you. If you back out for a reason related to that contingency after it’s removed, you may lose your earnest money deposit.

▶️ How It’s Done

Removing contingencies is done using the Contingency Removal Form (C.A.R. Form CR-B). Your agent will help you fill it out and submit it to the seller’s side.

Most buyers remove all remaining contingencies at once, but you can also remove individual ones in stages—or request an extension if you’re not ready.

▶️ What If You Can’t Remove One?

If something isn’t fully resolved—like pending loan approval, missing disclosures, or incomplete inspections—you may be able to request an extension for that specific contingency in stead of proceeding with a full removing of contingencies.

If the seller declines the extension, you’ll need to choose whether to proceed at your own risk or cancel the deal while your contingency is still in place.

▶️ You’re Take Away

Removing contingencies is a necessary step to move your home purchase forward—but each one you remove locks you in more deeply. That’s why it’s so important to understand what each one protects and make sure you’ve done your due diligence.

If you’re unsure, talk with your agent before signing anything. This isn’t the moment to rush—it’s the moment to confirm you’re ready. With the right preparation, you can move forward with confidence and clarity.

Removing contingencies

Resources in your Inbox

Sign up to get new posts emailed to you