David Mercier

Property Appraisal 101: What It Is, What to Expect, and What If It’s Low?

🏡 What Is a Property Appraisal and Why Does It Matter?

If you’re buying a home and getting a mortgage, your lender is going to require a property appraisal—no exceptions. Why? Because the bank wants to make sure the home is worth what you’re offering to pay before lending you a few hundred thousand dollars (or more).

In simple terms: the appraisal protects the lender from overfinancing a property. But it can also affect your buying power, your loan approval, and sometimes even whether the deal moves forward.

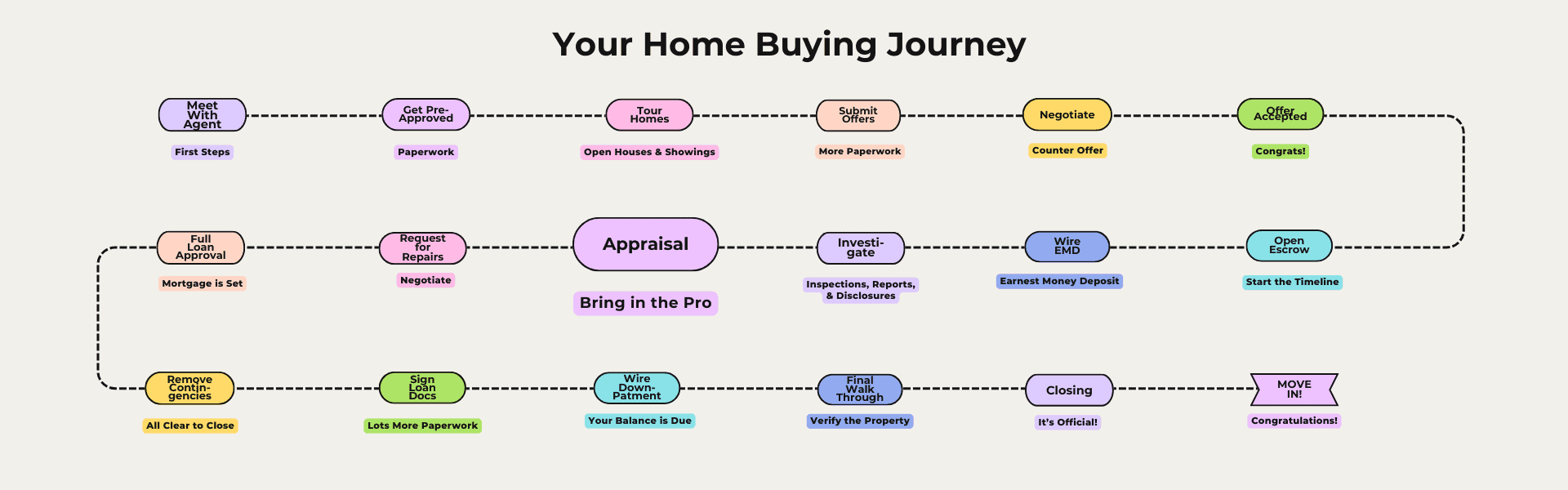

🏡This post is part of my Home Buying 101 series!

Whether you’re just getting started or deep into the search, this step-by-step guide is here to help you feel confident every step of the way.

From getting pre-approved to moving day, I’ve broken down the entire home-buying journey.

Make sure you add your questions in a comment or find me on Instagram and send me a DM: @davidkmercier

Who is this series for?

🔹 First-time buyers who want a clear roadmap.

🔹Move-up buyers ready for or on the path to their dream home.

🔹Investors looking to get started with a smart strategy and are considering options.

🔹 Anyone who hates surprises and wants to be fully prepared for their Home Buying journey!

David Mercier introduces the ultimate home-buying guide, walking you through every step of the process, from pre-approval to move-in day!

💰 Who Pays for the Appraisal?

In most cases, the buyer pays for the property appraisal, and it’s typically an out-of-pocket cost due upfront. Fees vary, but in California, it often ranges from $500 to $700.

💡 Pro Tip: Some lenders will give you a discount on the appraisal or waive the fee altogether as part of a promotional offer—so it never hurts to ask!

🔍 What Happens During an Appraisal?

The lender will hire a licensed third-party property appraiser who visits the property to assess its value. They’ll look at:

The home’s size and layout

➡️ Condition of the property

➡️ Recent upgrades or renovations

➡️ Comparable sales in the area (“comps”)

➡️ Overall market trends

Property Appraisers are independent from the buyer, seller, and lender. Their goal is to give an unbiased opinion of what the home is worth in today’s market.

⭐ Dream Homes Do Come True Club Members: Most agents just let the appraiser do their thing. I’ll be sure to be at the Appraisal Appointment to answer any questions and ensure they note

📄 Do I Get a Copy of the Report?

Here’s what surprises many buyers: you almost never receive the full property appraisal report.

Instead, you’ll usually hear something like:

“The appraisal came in at or above the purchase price.” 🙌

If that’s the case, everything moves forward as planned. No changes, no drama.

BUT… if the appraisal comes in below the purchase price, you will be told the exact appraised value—and that’s where things can get tricky.

⚖️ What Happens If the Appraisal Comes in Low?

If the property appraises for less than what you’re offering, the bank will not lend more than the appraised value. That leaves you with a few options:

1️⃣ Renegotiate with the Seller

You can ask the seller to reduce the purchase price to match the appraised value. This is done through the Request For Repairs process.

2️⃣ Pay the Difference Out of Pocket

If you’re still in love with the home, you can choose to cover the gap between the appraisal and your offer using your own funds.

3️⃣ Back Out (If You Have an Appraisal Contingency)

If your offer includes an appraisal contingency, you can walk away with your earnest money intact. It’s been my experience that a low appraisal is seldom reason for cancelling a deal. Sellers are usually willing to negotiate around it. However, if you can’t find middle ground you are protected by the appraisal contingency.

🤝 What Should You Do Next?

After the property appraisal in most cases, the next step is negotiation—and that might include price adjustments or other concessions. Head over to my full guide on the Request for Repairs phase where I’ll walk you through exactly how to handle seller negotiations, including how appraisal issues might influence your strategy.

💡 Pro Tip: You’ll often hear that the home “just needs to appraise”—but in a competitive market, that isn’t always guaranteed. It pays to be prepared.

You’re Take Away

The property appraisal is one of those hidden-in-plain-sight steps in the homebuying process. You don’t control it, you usually don’t see it, and yet it can dramatically shape the outcome of your purchase.

That’s why having a good agent (👋 that’s me!) matters. If your appraisal comes in low, we’ll review your options, renegotiate if needed, and make sure you’re not overpaying—or losing out unnecessarily.

Have questions about appraisals, contingencies, or seller negotiations? I’d love to help you move forward confidently.

property appraisal property appraisal

Resources in your Inbox

Sign up to get new posts emailed to you