David Mercier

How to Make an Offer on a House: What Smart Buyers Discuss with Their Agent

How to make an offer on a house? Writing an offer is an exciting and crucial step in buying a home, but it’s more than just picking a purchase price.

From fees and timelines to contingencies, the offer, also known as the Residential Purchase Agreement (RPA), includes many details that can make or break your offer. Let’s walk through what goes into an offer and the key points you should discuss with your agent before putting pen to paper.

🏡This post is part of my Home Buying 101 series!

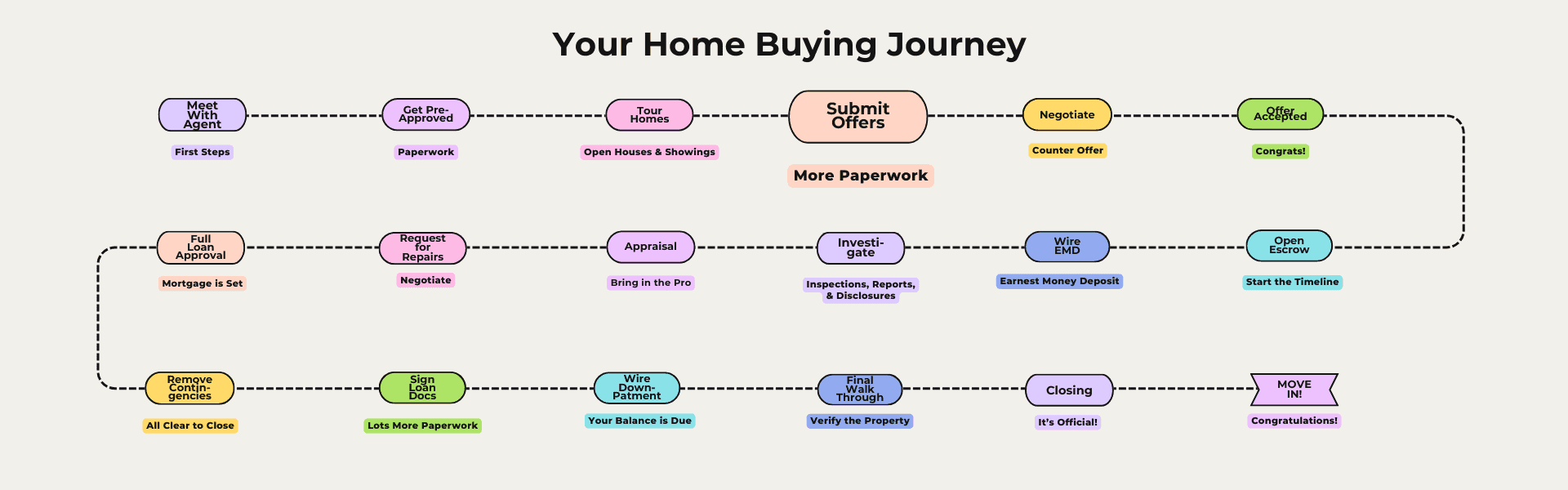

Whether you’re just getting started or deep into the search, this step-by-step guide is here to help you feel confident every step of the way.

From getting pre-approved to moving day, I’ve broken down the entire home-buying journey.

Make sure you add your questions in a comment or find me on Instagram and send me a DM: @davidkmercier

👉 Click here to view the full Home Buying 101 series

How to make an offer on a hous

Who is this series for?

🔹 First-time buyers who want a clear roadmap.

🔹Move-up buyers ready for or on the path to their dream home.

🔹Investors looking to get started with a smart strategy and are considering options.

🔹 Anyone who hates surprises and wants to be fully prepared for their Home Buying journey!

David Mercier introduces the ultimate home-buying guide, walking you through every step of the process, from pre-approval to move-in day!

Prefer to watch instead of read? 🎥 Check out the the Home Buying Journey video series!

1️⃣ The Purchase Price

This is the number everyone focuses on—but it’s not always as straightforward as it seems. Learning how to make an offer on a house included having the right conversations with your agent. Some buyers are laser-focused on getting a “deal” and prefer to offer below asking. Others are up against a tight deadline and are willing to pay over asking to secure the home quickly.

Discuss Market Conditions: Is the home in a competitive area where offers go above asking? Or is there room for negotiation?

Appraisal Considerations: Make sure your offer aligns with the likely appraised value to avoid issues with financing.

Pro Tip: The key is to be honest with your agent. Whether you’re value-driven or time-sensitive, your agent can help you develop a pricing strategy that fits your goals and works within the realities of the market. Remember, the right offer isn’t always the lowest—it’s the one that balances your priorities with the seller’s expectations..

⭐ Dream Homes Can Come True Club Members – Remember I’m on your side. It’s always better to be open and honest with me throughout the process!

2️⃣ Deposit and Earnest Money

Your earnest money deposit (EMD) is your way of showing the seller, “I’m serious.” It’s one of the first steps after your offer is accepted and officially kicks off the escrow process. In most cases, you won’t be able to begin inspections or investigations until the escrow company receives your EMD.

💰 How Much? In California, the standard EMD is typically 1–3% of the purchase price.

⏱️ When? Be prepared to wire your deposit quickly—usually within one to three business days after your offer is accepted.

Your EMD isn’t extra—it counts toward your total down payment. Then, toward the end of escrow, you’ll be required to wire the remaining balance of your down payment along with any fees you agreed to cover in the contract (like closing costs or specific transaction fees).

Pro Tip: Always confirm wiring instructions directly with your agent or escrow officer to avoid fraud. Wire scams are real, and your deposit is a big deal—never send funds without verifying first!

3️⃣ Allocation of Fees and Expenses

The Residential Purchase Agreement (RPA) outlines who pays for what—and how you structure this part of your offer can absolutely influence how it’s received by the seller. While some costs are typically shared or covered by one party, many are negotiable, and your agent can help you use these terms to strengthen your offer.

Here are a few common fees and who usually pays them (but again—everything’s up for discussion!):

-

Escrow Fees: Often split between buyer and seller, but this can vary by region.

-

Title Insurance: This protects against ownership issues and ensures a clean title transfer—who pays is part of the negotiation.

-

Home Warranty: Some buyers request the seller provide a one-year home warranty as part of the deal.

-

Transfer Taxes (if applicable): May be customary for the seller to pay, but not always.

-

Property Reports: These include things like the Natural Hazards Disclosure (NHD) and other required state or local disclosures.

💬 Ask your agent: Who typically covers these costs in your area? And more importantly—can adjusting these terms make your offer more attractive without increasing your purchase price? Sometimes it’s the fine print that makes all the difference.

4️⃣ Contingencies

Contingencies are conditions written into the purchase agreement that must be satisfied for the sale to proceed. These are designed to protect the buyer and ensure they have the opportunity to investigate the property, secure financing, and make an informed decision.

Here are some of the most common contingencies included in the California Residential Purchase Agreement (RPA):

-

Inspection Contingency: Allows you to conduct inspections and walk away or renegotiate if major issues are discovered with the home.

-

Appraisal Contingency: Ensures the property appraises at or above the purchase price—especially important when financing is involved.

-

Loan Contingency: Protects you if you’re unable to obtain the loan needed to complete the purchase.

-

Disclosures Contingency: Gives you time to review the seller’s disclosures, including statutory and contractual items, and cancel the deal if something doesn’t align with your expectations.

-

Sale of Buyer’s Property Contingency: If you’re selling your current home to finance the next one, this contingency allows you to proceed only if your existing home closes first.

Pro Tip: Shortening your contingency timelines can make your offer more competitive—especially in a hot market—but only if you’re fully confident in your financing, inspection readiness, and overall timeline. Your agent can help you find the right balance between being strategic and staying protected.

5️⃣ Timelines and Deadlines

Timing matters—especially in real estate. If you have specific dates you need to stick to, be upfront with your agent so they can help you craft an offer that aligns with your schedule while still appealing to the seller.

📅 Move-In Deadlines: Do you need to be out of your current home by a certain date or time your move with a job relocation or lease ending?

🏡 Home Sale Contingency: Are you relying on the sale of your current property before closing on your new one?

Your agent will help structure your offer timeline strategically—so it works for you and doesn’t raise red flags for the seller.

6️⃣ Personal Property and Inclusions

If there’s something in the home you love and want included in the sale—like appliances, light fixtures, or window treatments—make sure it’s written into the offer.

📌 Be specific. Don’t assume anything is included just because you saw it during the showing. If it’s not nailed down in the contract, it may walk away with the sellers.

Rule of thumb: if it’s not fixed to the house, like a shelf screwed to a wall or custom blinds, it’s generally not included with the sale. But it never hurts to ask for the things you want.

This small step can help avoid awkward misunderstandings down the road and ensure everyone is on the same page come closing day.

7️⃣ Additional Considerations

💌 Letter to the Seller: In competitive markets, a heartfelt letter can help humanize your offer—especially when price and terms are similar between buyers. It’s not always appropriate, but in the right situation, it can make a big difference.

🤝 Flexibility: Sellers often appreciate buyers who are flexible with closing dates, possession timelines, or minor terms. If you can accommodate the seller’s needs without hurting your goals, it could give your offer an extra edge.

Your Take Away

Learning how to make an offer on a house is about more than just numbers—it’s a carefully crafted agreement that balances your needs with the seller’s. By discussing purchase price, fees, contingencies, and timelines with your agent, you can create a competitive offer that puts you in the best position to secure your dream home. If you’re ready to make an offer in Orange County or Long Beach, I’d love to help! Let’s work together to make your offer a winning one.

How to make an offer on a house How to make an offer on a house How to make an offer on a house

Resources in your Inbox

Sign up to get new posts emailed to you