David Mercier

What Full Loan Approval Means (and What Happens Next)

Full Loan Approval is a home buying milestone!

You’ve negotiated repairs, completed your appraisal, and resolved any credits—now it’s time for one of the most critical milestones in the home-buying process: full loan approval. This is the moment your lender officially gives the green light to fund your loan. It’s a big deal, and it means you’re entering the final stretch. Let’s break down what this means, what’s happening behind the scenes, what you need to do next, and how it all leads to closing day.

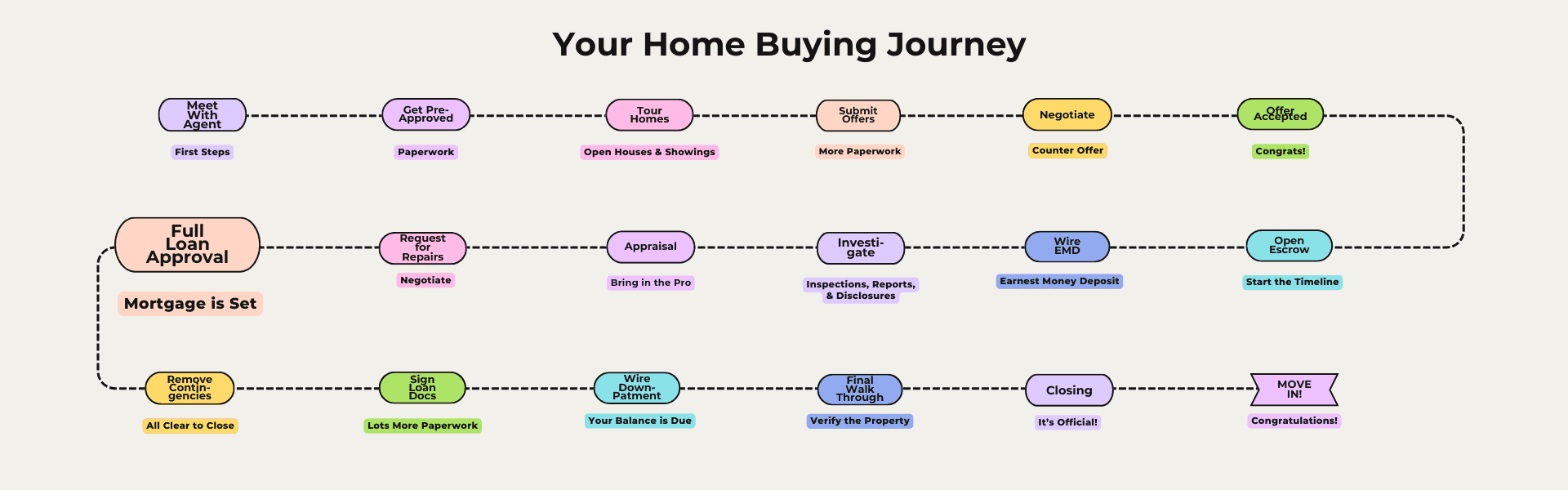

🏡This post is part of my Home Buying 101 series!

Whether you’re just getting started or deep into the search, this step-by-step guide is here to help you feel confident every step of the way.

From getting pre-approved to moving day, I’ve broken down the entire home-buying journey.

Make sure you add your questions in a comment or find me on Instagram and send me a DM: @davidkmercier

Who is this series for?

🔹 First-time buyers who want a clear roadmap.

🔹Move-up buyers ready for or on the path to their dream home.

🔹Investors looking to get started with a smart strategy and are considering options.

🔹 Anyone who hates surprises and wants to be fully prepared for their Home Buying journey!

David Mercier introduces the ultimate home-buying guide, walking you through every step of the process, from pre-approval to move-in day!

Prefer to watch instead of read? 🎥 Check out the the Home Buying Journey video series!

1️⃣ What Is Full Loan Approval?

Full loan approval means your mortgage lender has reviewed all required documents, verified your financial qualifications, and confirmed the property meets lending guidelines. In other words, they’ve signed off on your ability to repay the loan and are officially ready to move forward with funding.

It’s a stronger, more secure step than pre-approval—it’s your lender saying, “We’re ready to put the money on the table.” At this stage, there are no more “ifs” about your loan. It’s happening—as long as the final pieces fall into place.

2️⃣ What Happens Behind the Scenes?

Your file is sent through final underwriting, where your underwriter re-verifies everything to make sure there are no last-minute changes. That includes checking your income, assets, credit, employment status, and reviewing all required documentation for accuracy.

The underwriter also cross-checks details related to the property itself—like the appraisal, title report, and insurance—to ensure the home meets all lending requirements.

Once everything checks out, the lender issues what’s called a “clear to close”, which means they are now ready to release the loan funds for closing. This is a major green light and signals the transaction is officially in its final phase.

3️⃣ What You Need to Do

✅ Stay available and responsive: Your lender might reach out with last-minute document requests, like an updated pay stub or bank statement. Responding quickly helps prevent delays.

✅ Avoid big financial changes: Now is not the time to apply for new credit cards, buy a car, or make large purchases. Any big financial shift can affect your approval and cause last-minute underwriting issues.

✅ Keep your lender and agent updated: If something changes in your financial situation—like a new job, a big deposit, or a major expense—let your lender know immediately. Surprises at this stage can derail your timeline.

Even though this part can feel like a waiting game, being proactive and available makes a big difference. Treat this like the home stretch—it’s time to stay focused and steady.

4️⃣ What Comes Next

Once your loan is fully approved and you’re “clear to close,” here’s what you can expect:

📄 Loan documents are generated and sent to escrow: These are the final documents you’ll sign to legally finalize your loan agreement. Escrow will prepare your file and coordinate a signing appointment, which we’ll cover in detail in the next post.

📝 You’ll move toward removing any remaining contingencies: Once your financing is locked in, it’s time to officially commit to the purchase by removing contingencies. This is a critical legal step that shows the seller you’re all in.

📦 You can begin planning your move: With financing secured, it’s now safe to start scheduling movers, setting up utilities, and prepping for your transition into the new home.

You’re Take Away

Even though it might feel like things are slowing down after full loan approval, a lot is happening in the background. You’re on the home stretch—and soon, you’ll be signing loan documents and preparing for your final walkthrough and closing day.

full loan approval

Resources in your Inbox

Sign up to get new posts emailed to you