David Mercier

What is Escrow: and Why It’s Crucial in the Home-Buying Process

So what is escrow? Congratulations—you’ve had your offer accepted!

But before you pop the champagne, it’s time to open escrow. If you’re asking, “What is escrow, and why do we need it?” you’re not alone. Escrow can seem like a mystery, but it’s a critical part of protecting both buyers and sellers during a real estate transaction. Let’s dive into what escrow is, why it’s important, and what you should expect as you move forward.

What is Escrow

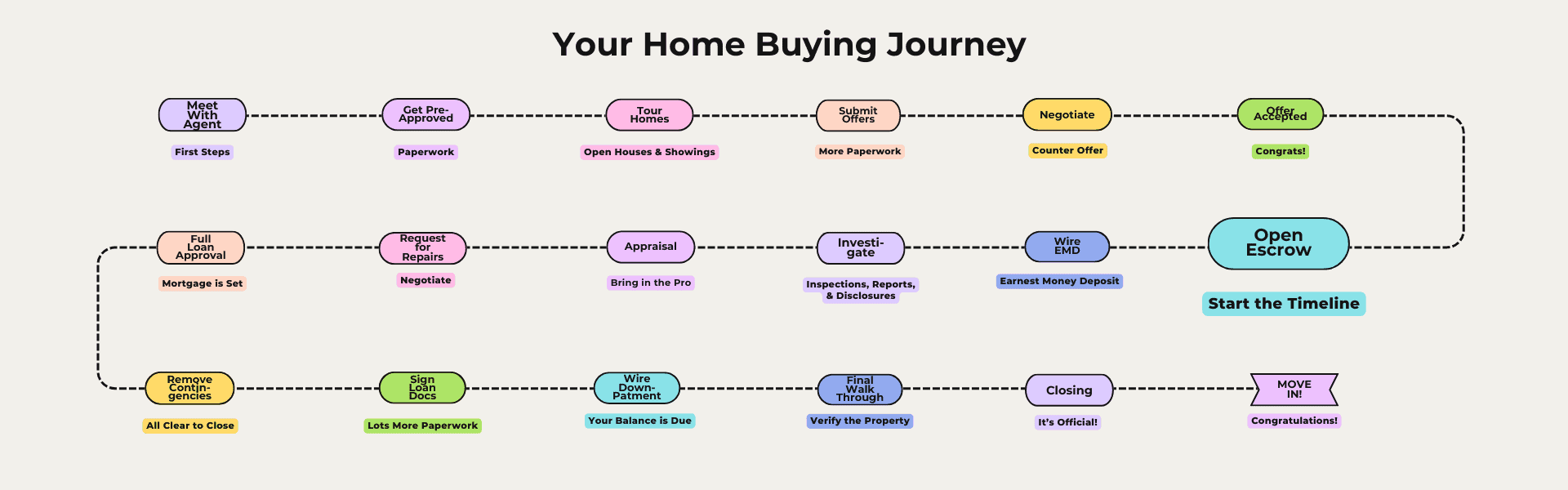

🏡This post is part of my Home Buying 101 series!

Whether you’re just getting started or deep into the search, this step-by-step guide is here to help you feel confident every step of the way.

From getting pre-approved to moving day, I’ve broken down the entire home-buying journey.

Make sure you add your questions in a comment or find me on Instagram and send me a DM: @davidkmercier

Who is this series for?

🔹 First-time buyers who want a clear roadmap.

🔹Move-up buyers ready for or on the path to their dream home.

🔹Investors looking to get started with a smart strategy and are considering options.

🔹 Anyone who hates surprises and wants to be fully prepared for their Home Buying journey!

David Mercier introduces the ultimate home-buying guide, walking you through every step of the process, from pre-approval to move-in day!

Prefer to watch instead of read? 🎥 Check out the the Home Buying Journey video series!

1️⃣ What is Escrow?

Escrow is a neutral third party that holds funds, documents, and instructions during the home-buying process. Think of it as a safe middleman ensuring both parties meet their obligations before the sale is finalized.

- For Buyers: Escrow holds your earnest money deposit and ensures the seller meets all conditions before funds are released.

- For Sellers: Escrow ensures you’ll be paid once all conditions are satisfied.

2️⃣ Why Do We Use Escrow?

Escrow provides security and accountability.

- Neutrality: Escrow protects both the buyer and seller by ensuring no one gets cheated.

- Organization: It keeps track of deadlines, documents, and deposits.

- Peace of Mind: You can trust that everything is handled fairly and professionally.

3️⃣ What to Expect When You Open Escrow

Once escrow is opened, the process officially begins. Here’s what you’ll need to do:

- Wire Your Earnest Money Deposit ASAP: Typically, you’ll need to wire your deposit within 1-3 days of the offer being accepted.

- Important Tip: Always confirm wiring instructions with your agent directly to avoid falling victim to wire fraud. Never send money without double-checking.

- Complete Escrow Instructions: You’ll sign documents outlining the process and key details.

4️⃣ Amendments and Changes to the Contract

From this point forward, any changes to the contract will require an amendment.

- Common Changes: These might include repairs after inspections or updated timelines.

- Communication is Key: Work closely with your agent to ensure amendments are documented and agreed upon by both parties.

5️⃣ Inspections and Contingencies During Escrow

This is the time to make sure the home meets your expectations.

- Inspections: Schedule professional inspections for the property (e.g., general, pest, roof).

- Appraisal: Your lender will order an appraisal to confirm the home’s value aligns with your loan.

- Contingency Periods: You’ll have deadlines to approve or remove contingencies (e.g., inspections, financing).

6️⃣ Escrow Isn’t Just for Buyers and Sellers

Escrow also involves:

- Lenders: They’ll coordinate loan funding through escrow.

- Title Companies: They’ll ensure there are no liens or issues with the property title.

7️⃣ Wrapping Up Escrow

When all conditions are met, escrow will:

- Disburse Funds: The seller receives their money, and you get the keys to your new home!

- Record the Deed: The title company records the deed with the county to finalize ownership.

Your Take Away

Escrow is the backbone of a smooth and secure real estate transaction. While it might seem overwhelming, your agent (that’s me, David Mercier!) is here to guide you every step of the way. From wiring your earnest money to navigating amendments, I’ll ensure you’re informed and confident.

Let’s make your home-buying journey seamless—reach out today to learn more!

What is Escrow

Resources in your Inbox

Sign up to get new posts emailed to you