David Mercier

Why Getting Mortgage Pre-Approval is a Key Step to Your Dream Home

Mortgage Pre-Approval can make or break your home buying experience.

Picture this: you walk into a home and instantly fall in love. It’s perfect in every way. But when you’re ready to make an offer, you find out another buyer has already scooped it up because you weren’t pre-approved for a mortgage. Getting pre-approved isn’t just a box to check—it’s your golden ticket to navigating the home-buying process confidently. Let’s dive into why it’s so important and how to shop around for the best lender.

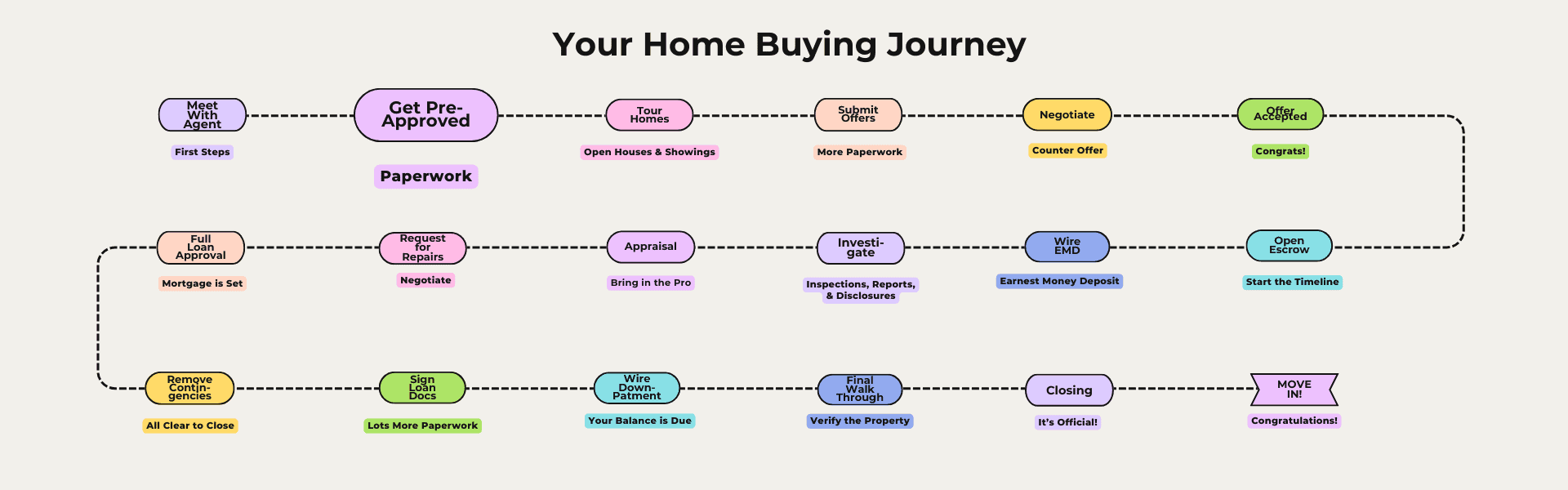

🏡This post is part of my Home Buying 101 series!

Whether you’re just getting started or deep into the search, this step-by-step guide is here to help you feel confident every step of the way.

From getting pre-approved to moving day, I’ve broken down the entire home-buying journey.

Make sure you add your questions in a comment or find me on Instagram and send me a DM: @davidmercierrealestate

Who is this series for?

🔹 First-time buyers who want a clear roadmap.

🔹Move-up buyers ready for or on the path to their dream home.

🔹Investors looking to get started with a smart strategy and are considering options.

🔹 Anyone who hates surprises and wants to be fully prepared for their Home Buying journey!

David Mercier introduces the ultimate home-buying guide, walking you through every step of the process, from pre-approval to move-in day!

Prefer to watch instead of read? 🎥 Check out the the Home Buying Journey video series!

Pre-approval is when a lender evaluates your financial situation and confirms how much they’re willing to lend you. It’s different from pre-qualification, which is more of an estimate. With pre-approval, you’ll get a letter that proves to sellers and agents that you’re serious and financially ready to buy a home.

✅ Why Pre-Approval Should Be One Of Your First Steps

Stronger Offers: Sellers take pre-approved buyers seriously because it shows you’ve done your homework and can secure financing.

Clear Budgeting: You’ll know exactly how much home you can afford, saving you time and disappointment.

Avoiding Heartbreak: Falling in love with a home outside your budget—or missing out because you’re unprepared—can be devastating. Pre-approval ensures you’re ready to act fast.

‼️ Pro Tip: Know what your monthly payment maximum is for your housing and use that to back into the budget for your home purchase. Don’t let lenders push you into a payment you’re not comfortable with.

✅ Shop Around for the Right Lender

Not all lenders are created equal! Here’s why you should meet with 2-3 lenders before committing:

Better Rates: Comparing lenders can save you thousands over the life of your loan.

Different Loan Options: Some lenders might offer programs that are a better fit for your financial situation.

Customer Service: Your lender will be with you through the home-buying process. Make sure you feel comfortable with them.

‼️ Pro Tip: Don’t be afraid to ask questions about interest rates, loan terms, and closing costs. You’re not just borrowing money—you’re making a big investment!

If you need some lender recommendations, reach out. I’ve worked with a number of them and they all have different benefits to offer. Remember you’re interviewing them, not the other way around!

✅ How to Prepare for Pre-Approval

If you have a traditional job, be prepared to gather the following:

▪️Proof of income (pay stubs, W-2s, or tax returns).

▪️Proof of assets (bank statements, investment accounts).

▪️Credit history.

▪️Identification.

Don’t have a traditional W-2 job? That’s okay—you can still get a mortgage! In fact, there are several alternative ways to qualify for a home loan, even if you’re self-employed, a freelancer, or a business owner. Lenders often offer programs based on bank statements, tax returns, or even asset-based income, giving you flexible options to prove your ability to repay the loan. It just takes the right strategy—and the right lender—to make it happen.

✅ The Risks of Skipping Pre-Approval

✅ The Risks of Skipping Pre-Approval

If you skip this step, you risk:

▪️Losing your dream home to a prepared buyer.

▪️Spending time looking at homes outside your budget.

▪️Facing delays during the offer process.

Your Takeaway

Getting mortgage pre-approved isn’t just a smart move—it’s a necessary one. It gives you the power to make confident, informed decisions and stand out as a serious buyer. Take the time to meet with multiple lenders, ask questions, and get pre-approved before you start shopping for homes. Trust me, it’s worth it!

Reach out when you’re ready to get started! Use this contact form or DM me on Instagram @davidkmercier

Mortgage Pre-Approval Mortgage Pre-Approval Mortgage Pre-Approval

Resources in your Inbox

Sign up to get new posts emailed to you