David Mercier

Signing Loan Documents: What to Expect Before Closing

Signing Loan Documents means you’re almost at the finish line!

After waiting for loan approval and removing contingencies, the next big step is signing your loan documents. This is one of the most crucial moments in the home-buying process because it finalizes your mortgage and prepares you for closing. But what exactly happens during this step, and what should you expect? Let’s go through everything you need to know about signing loan documents before closing on your new home.

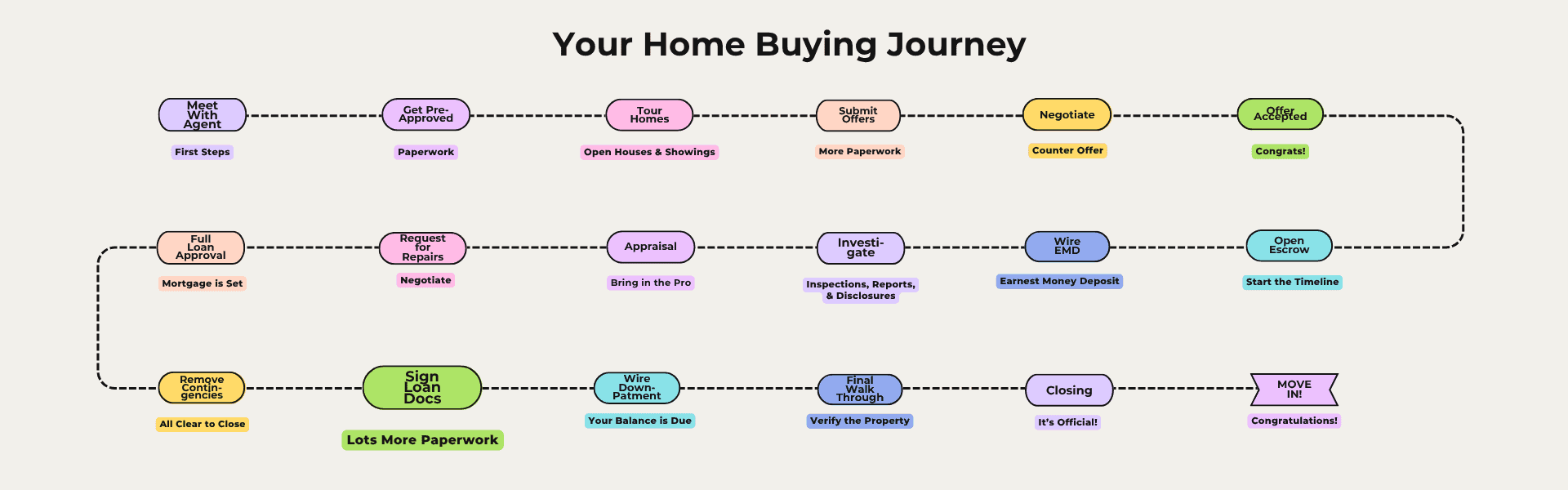

🏡This post is part of my Home Buying 101 series!

Whether you’re just getting started or deep into the search, this step-by-step guide is here to help you feel confident every step of the way.

From getting pre-approved to moving day, I’ve broken down the entire home-buying journey.

Make sure you add your questions in a comment or find me on Instagram and send me a DM: @davidkmercier

Who is this series for?

🔹 First-time buyers who want a clear roadmap.

🔹Move-up buyers ready for or on the path to their dream home.

🔹Investors looking to get started with a smart strategy and are considering options.

🔹 Anyone who hates surprises and wants to be fully prepared for their Home Buying journey!

David Mercier introduces the ultimate home-buying guide, walking you through every step of the process, from pre-approval to move-in day!

Prefer to watch instead of read? 🎥 Check out the the Home Buying Journey video series!

1️⃣ What Are Loan Documents?

Loan documents are the official paperwork that outlines the terms of your mortgage. They include:

- The Promissory Note – This is your official agreement to repay the loan under the stated terms (amount, interest rate, payment schedule).

- Deed of Trust (or Mortgage Note) – This secures the loan against the property, meaning the lender can claim the home if you fail to make payments.

- Loan Estimate & Closing Disclosure – These outline your final loan terms, interest rate, and closing costs. You should have received the Loan Estimate early in the process, and the Closing Disclosure should match it closely.

- Other Legal Documents – Various lender forms, affidavits, and tax-related paperwork.

Pro Tip: Review the Closing Disclosure ahead of time to ensure there are no unexpected fees or changes.

2️⃣ Where and When Do You Sign Loan Documents?

Typically, signing loan documents takes place at an escrow office, or with a notary at your home.

- When? Usually 1-3 days before closing.

- Who Needs to Be Present?

- You (the buyer)

- A notary public or escrow officer

- In some cases, your real estate agent or lender representative

Pro Tip: If you’re out of town or unavailable, you may be able to sign remotely using a mobile notary or an online notarization service (if allowed in your state).

3️⃣ What You Need to Bring

To prepare for signing loan documents, make sure you have:

✔ A valid government-issued ID (driver’s license, passport)

✔ Certified funds for any remaining closing costs or down payment (if wire transfer is required, confirm details with escrow to avoid fraud)

✔ A copy of your Closing Disclosure for reference

✔ Patience—this process can take 30-60 minutes!

Pro Tip: Wire fraud is a real concern. Always confirm wiring instructions directly with your escrow officer before sending any funds.

4️⃣ What Happens After You Sign?

Once you’ve signed all loan documents, here’s what happens next:

1️⃣ Loan Documents Are Sent to the Lender – The title company/escrow sends your signed paperwork back to the lender for final review.

2️⃣ Lender’s Final Review – The lender double-checks everything to ensure all terms are correct.

3️⃣ Funding the Loan – Once approved, the lender wires the loan funds to escrow.

4️⃣ Recording the Deed – The escrow company submits the deed to the county, officially transferring ownership to you!

Pro Tip: This process usually takes 1-2 business days after signing. If you sign late in the day or before a weekend/holiday, funding may be delayed.

5️⃣ Common Questions About Signing Loan Documents

💬 Can I change anything after signing loan documents?

- No, once you sign, the terms are final. That’s why reviewing everything before signing is crucial.

💬 What if there’s an error in the loan documents paperwork?

- If you catch a mistake, speak up immediately! The lender or escrow officer can correct it before finalizing.

💬 Do both spouses/partners need to sign loan documents?

- If both names are on the loan or title, then yes. Otherwise, only the borrower signs the mortgage documents.

💬 Can I back out after signing loan documents?

- In most cases, no. Once the loan is signed and funded, you are legally bound to the mortgage.

Your Takeaway

Signing loan documents is one of the final and most critical steps before closing on your new home. By understanding the process, reviewing documents carefully, and preparing ahead of time, you’ll ensure a smooth path to homeownership. If you’re buying in Orange County or Long Beach, I’m David Mercier—let’s make your home-buying journey stress-free! Reach out today!

signing loan documents

Resources in your Inbox

Sign up to get new posts emailed to you